Free for Life Credit Card UAE: Looking for a credit card in the UAE that is free for life? You’re in the right place! Many banks offer lifetime zero-annual-fee credit cards with excellent benefits like cashback, discounts, and travel perks. In this guide, we’ll explore the best options, their advantages, and how to choose the right card for your needs.

Why Choose a Free-for-Life Credit Card?

- Opting for a no-annual-fee-for-life credit card has several advantages:

- Cost Savings – You never have to worry about annual fees, making it a budget-friendly option.

- Rewards & Perks – Many of these cards offer cashback, discounts, and travel benefits.

- Ideal for Long-Term Use – Since there’s no renewal fee, you can keep these cards indefinitely without any extra costs.

Top Free for Life Credit Card UAE:

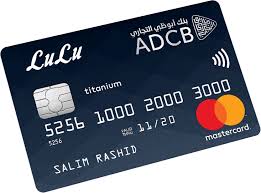

1. Emirates NBD Lulu 247 Mastercard

Annual Fee: Free for Life

Key Benefits:

Up to 7% cashback on Lulu purchases

0% interest installment plans

Free purchase protection

Ideal For: Frequent Lulu shoppers and those looking for cashback rewards

2. ADIB Cashback Visa Platinum Card

Annual Fee: Free for Life

Key Benefits:

1% unlimited cashback on all spends

Complimentary roadside assistance

Free airport lounge access

Ideal For: Everyday spenders who want cashback on all transactions

3. FAB Cashback Credit Card

Annual Fee: Free for Life

Key Benefits:

5% cashback on groceries, fuel, and dining

0% easy installment plans

Free travel insurance

Ideal For: Individuals who frequently spend on essentials

4. CBD Super Saver Credit Card

Annual Fee: Free for Life

Key Benefits:

10% cashback on supermarkets, fuel, and education expenses

Free travel benefits and lifestyle discounts

Ideal For: Families and high-spenders on daily essentials

5. HSBC Zero Credit Card

Annual Fee: Free for Life

Key Benefits:

No annual or hidden fees

Exclusive discounts on dining and entertainment

Ideal For: Those looking for a simple, no-frills credit card

How to Choose the Right Free for Life Credit Card UAE?

When selecting a no-annual-fee-for-life credit card, consider the following:

Spending Habits – Do you shop online, travel often, or spend more on groceries?

Rewards & Benefits – Choose a card that gives cashback or discounts relevant to your lifestyle.

Eligibility Criteria – Check the minimum salary requirements and other criteria before applying.

Additional Fees – While the annual fee is zero, ensure there are no hidden charges like late payment fees or high interest rates.

Frequently Asked Questions (FAQs): Free for Life Credit Card UAE

1. Are free-for-life credit cards really free?

Yes, these cards do not have an annual fee for life, but other charges like late payment fees or foreign exchange fees may still apply.

2. Can I get a free-for-life credit card with a low salary?

Many UAE banks require a minimum salary of AED 5,000 to AED 8,000. However, some options are available for lower-income individuals.

3. Do these cards offer rewards and cashback?

Yes, despite having no annual fees, most of these cards provide cashback, discounts, and travel perks.

4. Which is the best free-for-life credit card for online shopping?

The Mashreq Noon VIP Credit Card is great for online shoppers, offering 5% cashback on Noon purchases.

5. Is a free-for-life credit card better than a premium credit card?

It depends on your spending habits. If you want exclusive travel benefits, premium cards might be better. If you want to save money, a free-for-life card is ideal.

Conclusion: Free for Life Credit Card UAE

Free-for-life credit cards in the UAE are an excellent choice for budget-conscious individuals looking to enjoy rewards without extra costs. Choose a card based on your spending habits and enjoy the benefits without worrying about annual fees!

To Read More:-

Best Credit Cards in UAE Without Annual Fee

NAS Insurance UAE Hospital List