General Insurance Agent Commission Chart: Puri Jankari Hindi Mein

Agar aap ek General Insurance Agent banna chahte hain ya phir aap already ek agent hain, toh aapke liye commission structure samajhna bohot zaroori hai. Is blog mein hum General Insurance Agent Commission Chart ki puri jankari denge jo aapke liye beneficial hogi.

General Insurance Agent Commission Kya Hota Hai?

General insurance agents jo bhi policy bechte hain, uspe ek fixed percentage ka commission milta hai. Ye commission IRDAI (Insurance Regulatory and Development Authority of India) dwara fix kiya jata hai. Har category ki policy ke liye alag-alag commission rates hote hain.

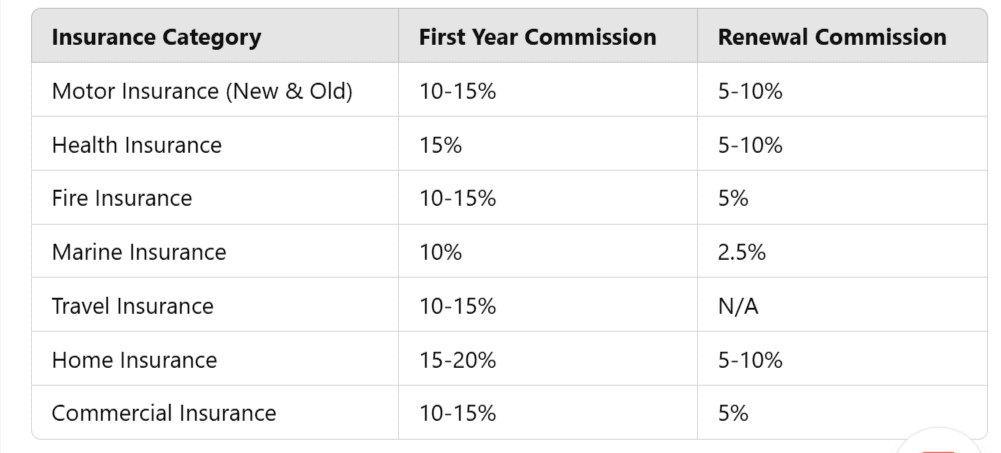

General Insurance Agent Commission Chart

Neeche diye gaye commission rates IRDAI ke guidelines ke anusar hai:

Note: Ye commission rates insurance company aur policy type ke according change ho sakte hain.

General Insurance Agent Banne Ke Fayde

Achha Commission Structure – General insurance policies bechne par agents ko achha commission milta hai jo ek acchi income source ho sakta hai.

Renewal Commission Ka Fayda – Ek baar bechi gayi policy par har saal renewal commission milta hai.

Koi Fixed Salary Ka Bandhan Nahi – Aap jitni policies bechenge, utni hi income hogi.

Insurance Industry Ka Growth – Insurance sector kaafi tezi se grow ho raha hai, isliye agents ke liye kaafi scope hai.

Flexible Work Timings – Aap apne time ke mutaabik kaam kar sakte hain.

General Insurance Agent Kaise Banein?

Agar aap general insurance agent banna chahte hain, toh neeche diye gaye steps follow karein:

- IRDAI Exam Pass Karein – Insurance Regulatory and Development Authority of India (IRDAI) ka exam clear karna hoga.

- Insurance Company Ke Saath Tie-up Karein – Kisi bhi general insurance company ke sath contract sign karna hoga.

- Training Complete Karein – Insurance company aapko policies aur selling techniques ki training degi.

- Licensing – IRDAI dwara approve hone ke baad aapko ek agent license milega.

- Policy Bechna Shuru Karein – Aap clients ke sath kaam karna shuru kar sakte hain aur apni commission kama sakte hain.

FAQs (Frequently Asked Questions)

Q1. General insurance agent ki income kitni hoti hai?

Aapki income aapki bechi gayi policies par depend karti hai. Jitni zyada policies bechenge, utni zyada earning hogi.

Q2. Kya general insurance agent ka fixed salary hota hai?

Nahi, general insurance agents ko fixed salary nahi milti. Unki income commission-based hoti hai.

Q3. Kya ek agent multiple insurance companies ke sath kaam kar sakta hai?

Haan, lekin aapko har company ke saath alag license lena hoga.

Q4. Kya general insurance me renewal commission milta hai?

Haan, health insurance, motor insurance, aur home insurance policies par renewal commission milta hai.

Q5. General insurance agent ke liye minimum qualification kya hai?

Aapko kam se kam 10th ya 12th pass hona chahiye aur IRDAI ka exam pass karna hoga.

Q6. Kya bina exam diye insurance agent ban sakte hain?

Nahi, IRDAI exam pass karna zaroori hai.

Conclusion

General insurance agent banna ek profitable career option ho sakta hai agar aap mehnat aur samajhdaari se kaam karein. Commission structure samajhna aur policies bechne ki strategy sahi tareeke se apply karna aapko ek safal agent bana sakta hai.

Agar aapko ye blog pasand aaya ho, toh ise share karein aur kisi bhi sawal ke liye comment karein!

Aur Bhi Blogs Ka Liya:-

Bank of Maharashtra Insurance Policy