LIC Jeevan Umang Premium Chart: Complete Guide:- Aap agar ek long-term insurance policy dhoondh rahe hain jo sirf protection hi nahi balki regular income bhi de, to **LIC Jeevan Umang Plan** aapke liye ek perfect choice ho sakta hai. Is plan ka premium chart aur features samajhne ke liye yeh blog likha gaya hai. Yahaan aapko Hindi aur English ka mix (Hinglish) mein simple aur easy-to-understand language milegi. To aayein, LIC Jeevan Umang ke baare mein detail mein samjhein.

### LIC Jeevan Umang Kya Hai?

LIC Jeevan Umang ek non-linked, whole-life insurance plan hai jo lifetime coverage ke saath-saath annual survival benefits bhi deta hai. Ye plan retirement ke baad ek regular income source ban sakta hai, jo financial security ke liye bahut zaroori hai.

### LIC Jeevan Umang Ke Main Features

– **Whole Life Cover**: Policyholder ko 100 saal ki umar tak cover milta hai.

– **Survival Benefit**: Policy term khatam hone ke baad har saal ek fixed amount milta hai.

– **Maturity Benefit**: Agar policyholder 100 saal ki age tak jeevit hain, to unko maturity benefit milega jo sum assured aur bonuses ka total hota hai.

– **Death Benefit**: Agar policy term ke dauraan policyholder ka dehant ho jaye, to unki family ko sum assured ke saath bonuses milte hain.

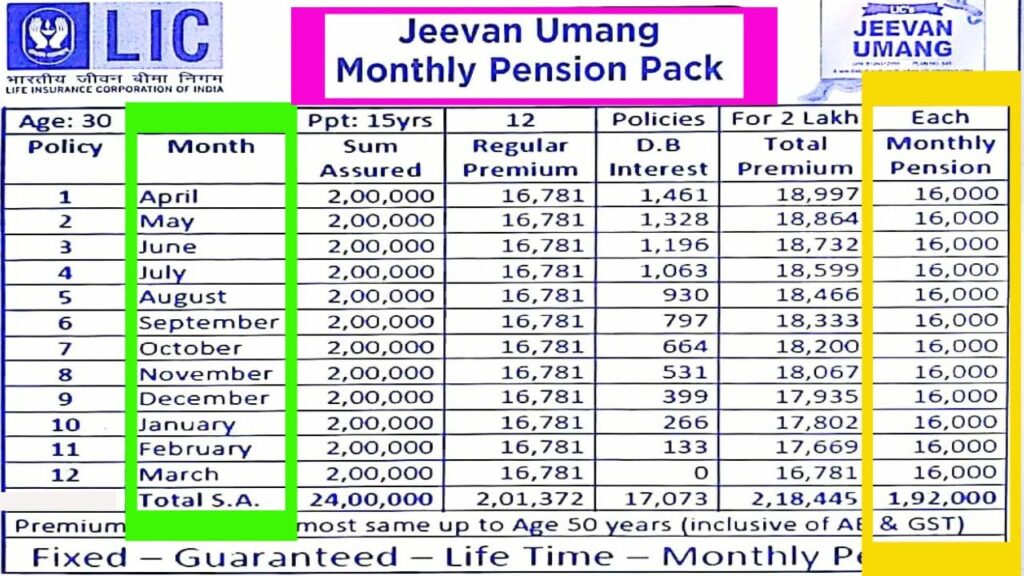

### LIC Jeevan Umang Premium Chart Kya Hai?

Premium chart ek table hai jo batata hai ki aapko apni age aur sum assured ke hisaab se kitna premium pay karna hoga. Aap yearly, half-yearly, quarterly, ya monthly premium choose kar sakte hain.

| **Age** | **Sum Assured (INR)** | **Yearly Premium (Approx)** |

|———|————————|—————————-|

| 20 | 2,00,000 | 10,500 |

| 30 | 2,00,000 | 11,200 |

| 40 | 2,00,000 | 12,300 |

| 50 | 2,00,000 | 14,000 |

(Note: Actual premiums LIC ke terms aur conditions par depend karte hain.)

### LIC Jeevan Umang Kaise Kaam Karta Hai?

1. **Premium Payment**: Aapko 15, 20, ya 25 saal tak premium pay karna hota hai. Iske baad aapka premium payment khatam ho jata hai.

2. **Survival Benefit**: Premium payment khatam hone ke baad aapko har saal survival benefit milega jo sum assured ka ek fixed percentage hota hai.

3. **Maturity Benefit**: Agar aap 100 saal ki umar tak zinda hain, to maturity benefit milega jo sum assured ke saath bonuses bhi include karta hai.

4. **Death Benefit**: Agar policyholder ki death ho jaye, to unke nominee ko death benefit milega.

### LIC Jeevan Umang Premium Chart Kaise Samjhein?

Premium chart samajhna easy hai:

– **Age Factor**: Aapki age jitni kam hogi, premium utna hi kam hoga.

– **Sum Assured**: Sum assured jitna zyada hoga, premium bhi utna hi zyada hoga.

– **Policy Term**: Policy term ke hisaab se premium amount decide hota hai.

### LIC Jeevan Umang Ke Benefits

1. **Lifetime Coverage**: Policyholder ko 100 saal tak coverage milti hai.

2. **Regular Income**: Retirement ke baad annual income milti hai.

3. **Tax Benefits**: Premium payments aur maturity benefits dono par tax benefits milte hain.

4. **Financial Security**: Family ke liye ek secured future ka assurance.

### LIC Jeevan Umang Ka Premium Calculator Kaise Use Karein?

Premium calculator ek online tool hai jo aapko premium aur benefits ka exact estimate deta hai. Bas aapko apni age, sum assured, aur policy term dalni hoti hai.

### Example Calculation

Agar aapki age 30 saal hai aur aap 5 lakh ka sum assured lete hain:

– **Policy Term**: 20 saal

– **Annual Premium**: ₹25,000 (approx.)

– **Survival Benefit**: ₹40,000 har saal after policy term

– **Maturity Benefit**: ₹7,50,000 (approx., including bonuses)

### Kya LIC Jeevan Umang Aapke Liye Sahi Hai?

Agar aapko lifetime coverage chahiye aur retirement ke baad ek fixed income source ki zarurat hai, to ye plan ek excellent choice hai. Iska premium chart aapko apni financial planning karne mein help karega.

### Conclusion

LIC Jeevan Umang ek perfect combination hai insurance aur savings ka. Iska premium chart samajhne se aap apni affordability ke hisaab se best plan choose kar sakte hain. Agar aapko is plan ke baare mein aur details chahiye, to LIC ke official website ya apne nearest LIC agent se contact karein.

Jaldi karein aur apna aur apni family ka future secure karein LIC Jeevan Umang ke saath!