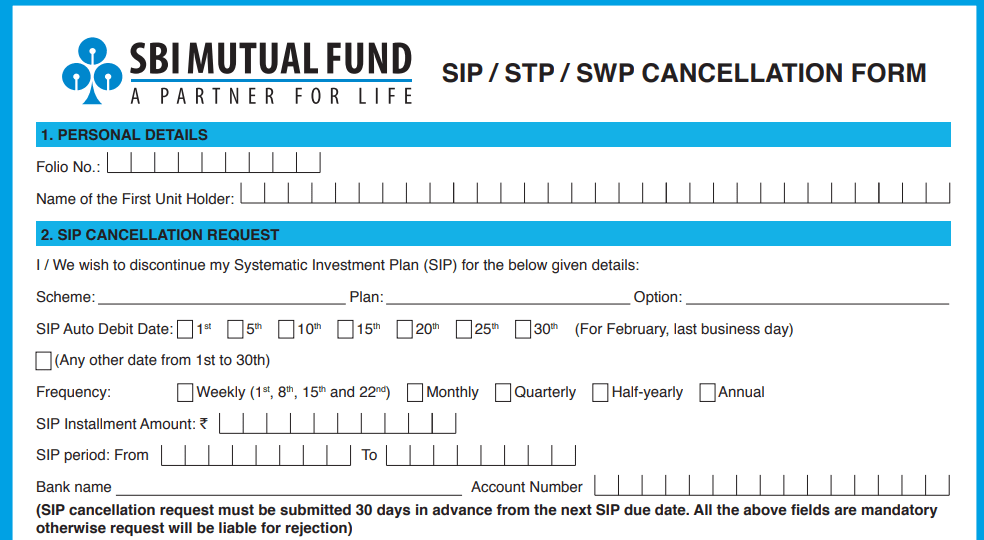

SBI SIP Form: Title: “SBI SIP Form: An Easy and Safe Investment Choice” The SBI SIP Form is a crucial step towards investment. It offers the general public a secure and simple option for investing through SBI Mutual Fund. By filling out this form, you can apply for investment and grow your investment with financial independence and stability.

Filling out the SBI SIP Form is straightforward. You need to provide your name, address, PAN card number, bank account details, and investment amount. After filling out the form, you need to submit it at your nearest SBI branch.

By filling out the SBI SIP Form, you can invest your money in financial plans according to your financial goals and needs. This investment method ensures long-term financial stability in a secure and reliable manner.

SBI SIP Form Download:

The SBI SIP (Systematic Investment Plan) offers several benefits to investors:

1. **Rupee Cost Averaging**: With SBI SIP, investors can benefit from rupee cost averaging. By investing a fixed amount regularly, investors automatically buy more units when prices are low and fewer units when prices are high, averaging out the cost over time.

2. **Discipline in Investing**: SIP instills discipline in investors by encouraging regular investments. It helps inculcate a habit of saving and investing systematically over the long term, regardless of market fluctuations.

3. **Convenience**: SBI SIP offers convenience to investors as it allows them to automate their investments. Once set up, investments are deducted automatically from the investor’s bank account at regular intervals, eliminating the need for manual intervention.

4. **Flexibility**: Investors have the flexibility to choose the frequency of investments (monthly, quarterly, etc.) and the amount they want to invest. This flexibility makes it suitable for investors with varying financial capabilities and goals.

5. **Power of Compounding**: SBI SIP harnesses the power of compounding by reinvesting the returns earned on investments. Over time, this compounding effect can significantly boost the value of the investment portfolio, especially when invested for the long term.

6. **Risk Mitigation**: Investing through SIP helps mitigate the risk of timing the market. Since investments are made regularly, investors are less exposed to market volatility, reducing the risk of making large investments during market peaks.

7. **Accessibility**: SBI SIP is accessible to a wide range of investors, including retail investors, through various schemes offered by SBI Mutual Fund. Investors can choose from a diverse range of equity, debt, and hybrid funds based on their risk appetite and investment objectives. Overall, SBI SIP provides a convenient, disciplined, and effective way for investors to create wealth and achieve their financial goals over the long term.

To Know More About SBI SIP Form:

To Read More blogs:

Punjab National Bank RTGS Form pdf Download