Online Income Tax Return India – Every citizen who has taxable income & whose accounts are not liable to be audited then he must file an Income Tax Return. The individual can file an online income tax return in India through the income tax website https://www.incometaxindiaefiling.gov.in/ or get it filled out by authorized income tax assistants, CA or ICWA.

The individual must have PAN number to file an income tax return in India. He has to register his account in the income tax website before filing the income tax return.

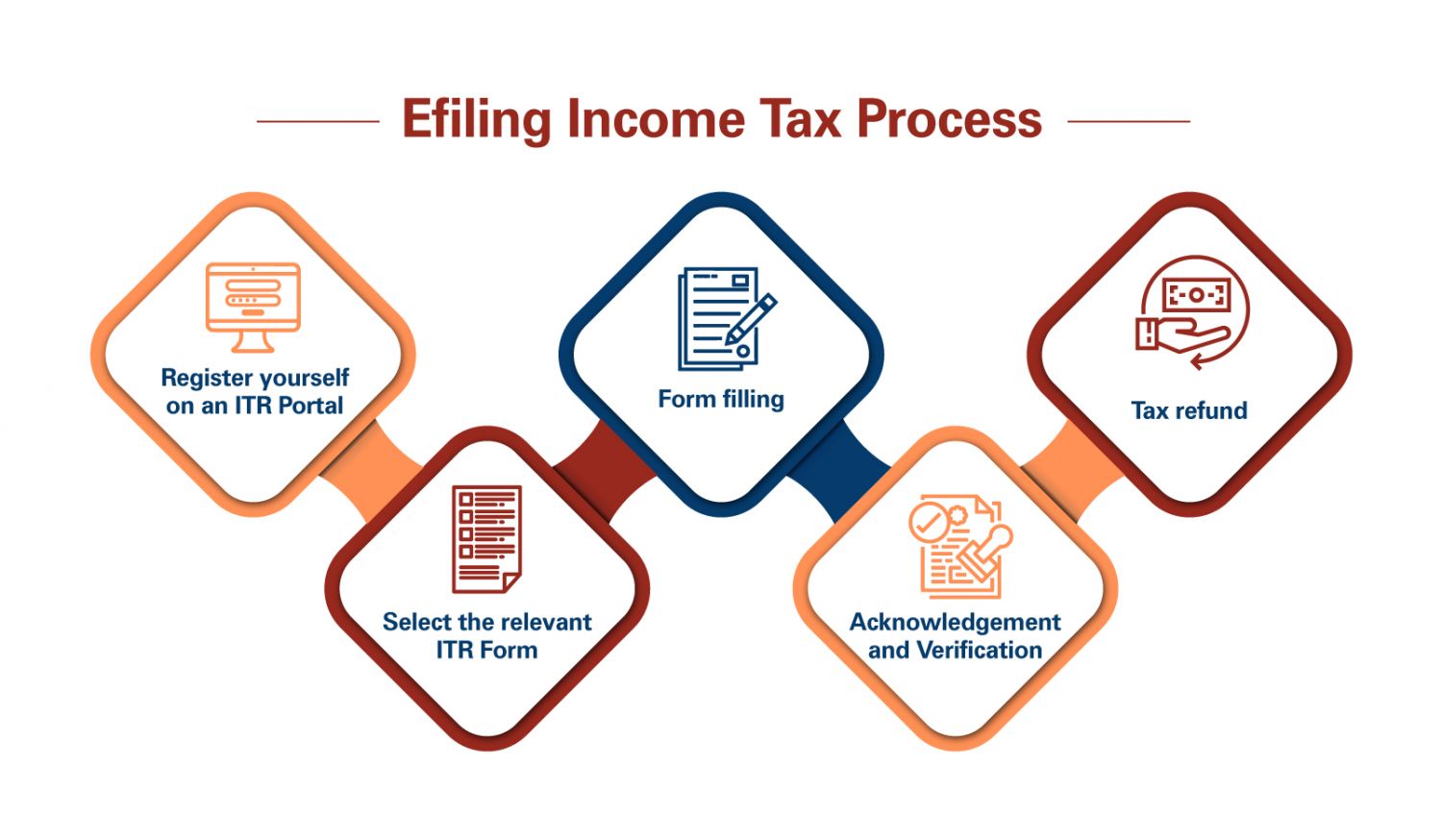

Following is the step-by-step guide to file ITR return in India:-

Online Income Tax Return India Different Types of Forms

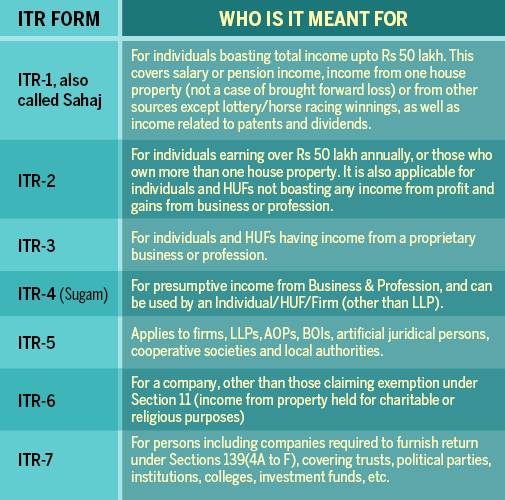

We have various types ITR forms as per the types of employment or self-employment or business. Following are the types of ITR Forms are used for online income tax return filing in India:-

ITR 1

Citizens who live in India and earn up to Rs 50 lakh annually are eligible. Anyone who makes money from a job, a house, or other sources may file an ITR-1. An ITR-1 cannot be filed by an NRI. Salaried taxpayers may file ITRs using Form 16.

ITR 2

People and HUF for income from sources other than their venture or occupation. People and NRIs who bring in cash from a task, a home, capital increases, or different sources might record Structure ITR-2. ITR-2 might be documented by salaried individuals who have created gains or harms from stock buys and deals.

ITR 3

The citizen uses the ITR 3 form to submit income tax returns. It applies to people and Hindu Undivided Families (HUFs) who are business partners and earn money through their job or business. If a person’s total income for the tax year includes revenue from a partnership firm, ITR 3 must be filed. The form requests details on the person’s earnings, outgoings, and assets. The Income Tax Department of India’s e-filing system is where it must be submitted before the deadline, which is usually July 31st of every year.

ITR 4

When a business has a turnover of up to Rs 2 crore and is subject to section 44AD taxation, its revenue is reported using the ITR-4 form. Additionally, ITR-4 is for income from a profession that is subject to section 44ADA taxation and has a turnover of up to Rs 50 lakh. A freelancer who performs work in a notified occupation may submit an ITR-4.

ITR 5

It applies to people other than individuals and Hindu Undivided Families (HUFs), such as businesses, associations of people, bodies of people, limited liability partnerships, and corporations. The form asks for details about the entity’s earnings, outlays, and possessions.

ITR 6

It is a form that businesses use to declare all other types of income in addition to earnings from their industry or occupation.

.

ITR 7

This covers individuals who have income from assets kept for charitable or religious purposes, income from sources outside of India, and individuals who must file a return in accordance with section 292B of the Income Tax Act. The form requests details about the applicant’s earnings, outgoings, and possessions.

Following are the three important forms that are essential to file online income tax returns in India:-

Form 26AS

In India, the Income Tax Department produces Form 26AS, a tax credit statement.

The tax deducted at source (TDS), the tax collected at source (TCS), as well as any advance tax or self-assessment tax paid by the taxpayer during the financial year are all detailed in this document.

The Income Tax Department of India’s official e-filing website, TRACES (TDS-CPC), allows users to see and download Form 26AS.

For taxpayers, this form is essential because it enables them to confirm the amount of tax that has been withheld from or collected on their behalf and guarantees that they are given credit for it when filing their income tax returns.

Form 16

In India, Form 16 serves as a certificate of tax deducted at source (TDS). It is given by an employer to an employee and shows the amount of tax withheld from their pay over the course of a fiscal year.

Form 16 is split into two sections: Along with the employee’s PAN and information about the salary received, Part A also includes the employer’s information and TAN.

The employee’s wage, any deductions made in accordance with Chapter VI-A of the Income Tax Act, and the amount of tax deducted are all broken down in Part B. On or before June 15 of the following fiscal year, the employer must provide the employee with Form 16.

It is an important document for workers because it aids in the submission of their income tax returns.

Form 15G and Form 15H

Using Forms 15G and 15H, you can generate money without paying TDS. You can submit Form 15G if your basic exemption cap is less than your gross taxable income and you are under the age of 60.

You must submit Form 15H if you are a senior and have no tax due on your net wage. You must submit Form 15G or Form 15H to the person who is responsible for paying your taxes.

Following is the comparison between the old tax slab vs the new tax slab after budget 2023 for Online Income Tax Return India:-

New tax slabs

| Income Tax Slab (in Rupees) | Income Tax Rates (%) |

|---|---|

| Between 0 to 3,00,000 | 0% |

| Between 3,00,001 to 6,00,000 | |

| Between 6,00,001 to 9,00,000 | |

| Between 9,00,001 to 12,00,000 | |

| Between 12,00,001 to 15,00,000 | |

| Between 0 to 3,00,000 | |

| Above 15,00,000 |

1) No tax would be levied for income up to ₹3 lakh

2) Income between ₹3-6 lakh would be taxed at 5 percent

3) Income between ₹6-9 lakh would be taxed at 10 percent

4) Income between ₹9-12 lakh at 15 percent

5) Income between ₹12-15 lakh at 20 percent

6) Income of ₹15 lakh and above will be taxed at 30 percent.

Old tax slabs

1) Income up to ₹2.5 is exempt from taxation under the old tax regime.

2) Income between ₹2.5 to ₹5 lacks is taxed at the rate of 5 percent under the old tax regime.

3) Personal income from ₹5 lacks to ₹7.5 lahks is taxed at a rate of 15 percent under the old regime

4) Income between ₹7.5 lacks to ₹10 lacks is taxed at a rate of 20 percent in the old regime

5) Under the old regime personal income above ₹10 lacks is taxed at a rate of 30 percent.

The individuals can file the ITR return by themself by visiting the eITR website of the government. In addition loans4dreams, also has teams CA & authorized tax assistant which provide online tax filing services at nominal charges

Many of our Readers can file their ITR Return by themself but many of them required expert support.