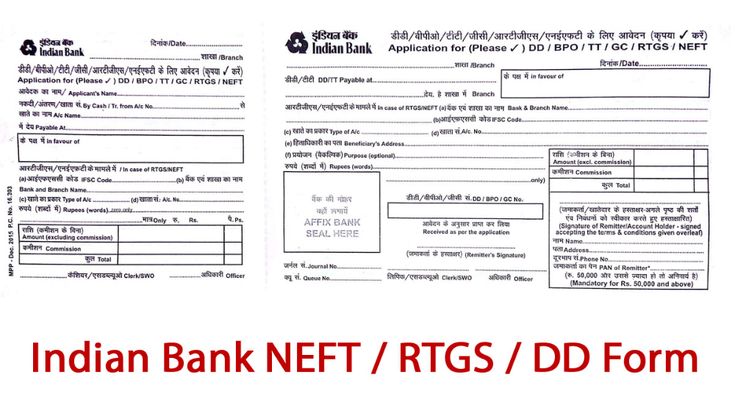

Indian Bank RTGS Form: Namaskar dosto! Aaj hum baat karne ja rahe hain RTGS (Real Time Gross Settlement) ke bare mein aur uske saath judi Indian Bank RTGS Form ke baare mein. RTGS ek tarah ka electronic fund transfer system hai, jisse ek bank se doosre bank mein paisa transfer kiya ja sakta hai, real-time mein. Is process ko samajhne ke liye, aaiye shuru karte hain Indian Bank RTGS Form ke bare mein vistar se baat karte hain.

Indian Bank RTGS Form PDF Download:

Indian Bank RTGS Form Kya Hai?

RTGS ka upyog karke bade rashiyo ka turant aur surakshit roop se transfer kiya ja sakta hai. Indian Bank RTGS Form, is prakriya ko shuru karne ke liye zaroori hai. Ye ek prakar ka application form hota hai, jise bharte samay dhyan rakhna zaroori hai.

Indian Bank RTGS Form Bharte Samay Kya-Kya Zaroori Hai?

- Payer aur Payee Ke Account Details: Form mein payer aur payee ke account details ko sahi taur par bharna avashyak hai. Yehi details transaction ke safalta purvak hone ki guarantee deti hain.

- Transaction Amount: Aapko RTGS ke madhyam se kitni rashi transfer karni hai, yeh bhi form mein darj karna hota hai.

- IFSC Code: IFSC code ek unique code hota hai, jo har bank branch ka hota hai. Is code ki madad se transaction sahi bank branch mein pahuchaya ja sakta hai. Isliye, IFSC code ko dhyan se bharna chahiye.

- Signature: Form mein signature dena bhi bahut zaroori hai, kyun ki yeh transaction ki authenticity ko verify karta hai.

Indian Bank RTGS Form Kaise Bhare?

- Indian Bank RTGS Form ko bharte waqt kuch zaroori baaton ka dhyan rakhna behad mahatvapurna hai:

- Dhyan Rakhe Account Details Mein Sahi Jaankari Deni Chahiye:** Form mein payer aur payee ke account details ko sahi taur par bharna zaroori hai. Yadi galat details di gayi toh transaction fail ho sakta hai.

- Transaction Amount Ko Sahi Bharein:** RTGS transaction mein kitni rashi transfer karni hai, yeh bhi dhyan se bharna chahiye.

- IFSC Code Ko Verify Karein:** IFSC code ko dhyan se bharna chahiye aur yeh sahi hai ya nahi, yeh bhi verify kar lena chahiye.

- Form Ko Dhyan Se Sign Karein:** Form ko puri tarah se bharte waqt, signature ko na bhoolen. Signature ke bina transaction complete nahi ho sakta hai.

Kuch Zaroori Points

- RTGS transactions usually bank working hours ke dauraan hi kiya ja sakta hai, isliye aapko transaction ka samay bhi dhyan mein rakhna chahiye.

- RTGS ke through kiye gaye transactions immediate aur final hote hain, isliye ek baar transaction kar diya toh use wapas nahi kiya ja sakta hai.

- Upar di gayi jaankariyon ko dhyan mein rakhte hue, aap Indian Bank RTGS Form ko sahi tarike se bhara sakte hain aur paisa turant aur surakshit taur par transfer kar sakte hain. Agar aapka koi sawal ho ya aur adhik jaankari chahiye ho, toh aap apne bank se sampark kar sakte hain.

- Umeed hai ki aapko yeh blog pasand aaya hoga. Agar aapko kuch aur jaankari chahiye ho, toh hamein comment section mein likh kar zaroor batayein. Dhanyawaad!

- Is blog mein samjhaya gaya hai ki Indian Bank RTGS Form kaise bhara jata hai aur kin-kin baaton ka dhyan rakhna zaroori hai.

Indian Bank RTGS Form Aur Bhi Information Ka Liya:

Conclusion: Indian Bank RTGS Form

Toh dosto, is blog mein humne Indian Bank RTGS Form ke bare mein vistar se baat ki hai. RTGS ek surakshit aur tezi se paisa transfer karne ka ek mahatvapurna tarika hai, aur Indian Bank RTGS Form uss prakriya ko shuru karne ke liye avashyak hai.

Humne dekha ki form bharte samay kuch zaroori baaton ka dhyan rakhna zaroori hai, jaise sahi account details dena, IFSC code ko verify karna, aur form ko sahi tarike se sign karna. Yeh sabhi kadam surakshit aur sahi transaction ko guarantee karte hain.

Umeed hai ki yeh jaankari aapko RTGS process ko samajhne mein madadgar sabit hogi aur aap bhi ab is process ka istemal karke badi rashiyo ko surakshit taur par transfer kar payenge. Agar aapko aur koi jaankari chahiye ho, toh hamein comment section mein likh kar zaroor batayein.

Dhanyawaad!

Aur Bhi Blogs Ka Liya:

SKS Microfinance Contact Number