We Loans4dreams.com provides Income Tax Return (ITR) filing services for all types of salaried person in India. It is a completely online process wherein employees don’t need to go anywhere, they just need to upload the required documents, and then our team of qualified CA’s will evaluate & file accurate ITR according to the information you provide at the earliest. ITR Filing for salaried employees by loans4dreams.com is an easy and simple process which also a CA-assisted return filing.

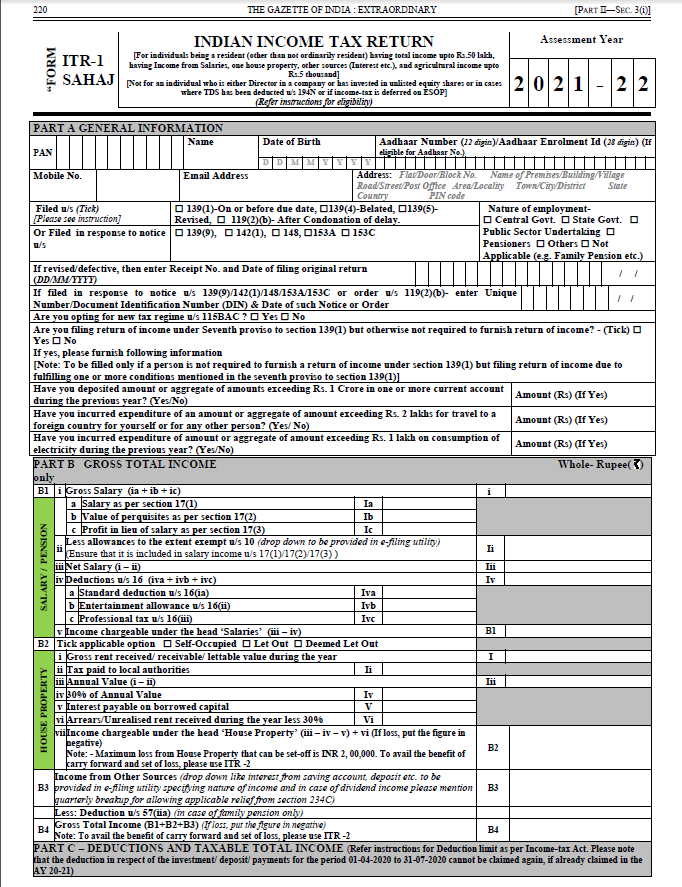

Let us first understand what is ITR 1 or Sahaj Form

ITR 1 or Income Tax Return Form 1, is also called Sahaj which means easy form. This form is applicable for a salaried person like salary/pension/family pension and interest income. ITR 1 form can be only filled by an individual having an income of less than or equal to Rs 50 lacs.

Who Can File ITR1 or Sahaj Form?

This form can be used to file Income Tax Return who have income only for the below-mentioned income heads:-

- SALARIES

- INCOME FROM HOUSE PROPERTY

- INCOME FROM OTHER SOURCES

- INCOME LESS THAN 50 LACS

Is it Mandatory to File ITR for Salaried Persons?

The filing of an income tax return (ITR) is a way of self-declaring to the government about the total income that you have earned in the current financial year and that you have paid taxes on that income accordingly (As per the latest income tax rules, it is mandatory for an individual to file ITR if his income/expenditure/investments meet certain criteria). All the salaried person have to file ITR return as per the latest directive of Income Tax Authorities.

How to file ITR 1 or Sahaj Form?

The Income Tax Authorities have provides the best option of filing Income Tax Return online electronically through their website. Our salaried person has to file ITR 1 or Sahaj Form through their website. It is necessary to file the correct ITR1 form due to its implications if we did the wrong filing. Loans4dreams.com platform is the best service provider for filing your ITR1 Form with nominal charges.

We are known for our quick and simple services for filing ITR 1 for salaried people with our team of CAs. Once you submit every required documents then within 24 hrs, your IT Return gets filled with perfect correctness.

It is important to have Aadhar linked mobile number for filing of ITR1 Return for salaried person in India.

Following is the Link for Filing ITR1 from Loans4dreams.com

Benefits of ITR Filing for Salaried Person or Employees:-

- Buying a High Life Cover

- Ease of Getting Loans

- Helpful for those with very small earnings

- Faster Visa Processing

- Proof of Accumulated earnings over the years

- Safety from Notice from ITR Department

- Claiming of Tax Refund

- Serves as the Proof of Income

- TDS Rebate

- One can Cary forward the Losses

FAQs for ITR for Salaried Person

Which is the ITR Form for Salaried Person?

ITR1 or Sahaj form is applicable for Salaried persons whose income is less than or equal to 50 lacs. Generally, all government employees, state government employees, central government employees, private employees are required to fill ITR1 form.

What is ITR OR Income Tax Return?

Income tax return or ITR are set of documents which is need to be submitted by all Indian taxpayers to the Tax authority every year.

What is the last date to submit ITR AY 2021-22?

The last date to fill and submit ITR AY 2021-22 is 31 Jul 2021

What is Form 16?

Form 16 is the most important document for filling ITR1 or Sahaj form for the Salaried Person in India. Form 16 is a certificate or form which have all the details of the yearly money he received from the employer and deduction is also mentioned. This form is issued by the employer to all their salaried individuals when he deducts tax from the employee salary. It is information which tells to an employee about the deducted tax which has been deposited with the Income Tax department. It must be issued by 15th June of the year for which it is being issued.

What is Form 16A?

Form 16A is applicable for TDS on Income Other than Salary. Generally, a Form 16A is issued to you

(a) when a bank deducts TDS on your interest income from fixed deposits of the banks

(b) when a TDS is deducted on insurance commission

(c) when a TDS is deducted on your rent receipts

(d) Generally, when a TDS is deducted on any other income you get for that year is liable for such deduction