LIC Loan Application Form No 5205: Title: Easy Steps to Apply for a LIC Loan: Understanding Form No. 5205 and Download the latest form from this blog post

Hey there, folks! Are you an LIC (Life Insurance Corporation) policyholder in need of some financial assistance? Did you know that you can avail of a loan against your LIC policy? Well, you’re in luck! In this blog post, we’re going to guide you through the simple process of applying for a LIC loan using Form No. 5205. So, sit back, relax, and let’s dive into the world of LIC loans!

Understanding LIC Loans: Before we jump into the nitty-gritty of the loan application process, let’s take a moment to understand what LIC loans are all about. LIC offers policyholders the option to avail of loans against their policies, providing them with much-needed liquidity during times of financial need.

These loans are secured by the value of the policy and can be a convenient source of funds for various purposes.

Steps to Apply for a LIC Loan (LIC Loan Application Form No 5205):

1. **Check Loan Eligibility**: The first step is to determine whether your LIC policy is eligible for a loan. Not all policies offer this feature, so it’s essential to check the terms and conditions of your policy or consult your LIC agent for clarification.

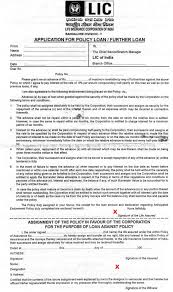

2. **Download Form No. 5205**: Once you’ve confirmed your policy’s eligibility, you can proceed to download Form No. 5205, which is the loan application form. You can easily find this form on the official LIC website or by visiting your nearest LIC branch.

3. **Fill Out the Form**: Now comes the easy part—filling out the loan application form. The form requires basic information such as your policy details, personal details, loan amount requested, and the purpose of the loan. Make sure to double-check all the information for accuracy before submitting the form.

4. **Submit Required Documents**: Along with the loan application form, you’ll need to submit certain documents as proof of identity, address, and income. These documents may include PAN card, Aadhaar card, passport, utility bills, salary slips, etc. Be sure to have these documents ready to expedite the loan processing.

5. **Wait for Approval**: Once you’ve submitted the loan application form and documents, all that’s left to do is wait for LIC to process your request. The approval process may take some time, so be patient and keep an eye out for any communication from LIC regarding the status of your loan application.

6. **Receive Loan Disbursement**: Congratulations! If your loan application is approved, LIC will disburse the loan amount directly to your bank account. You can then use the funds as per your requirement, whether it’s for emergencies, education, medical expenses, or any other financial need. Conclusion:

Applying for a LIC loan using Form No. 5205 is a simple and hassle-free process.

By following the steps outlined above and providing the necessary documents, you can access much-needed funds quickly and conveniently. So, if you find yourself in need of financial assistance, don’t hesitate to explore the option of availing a loan against your LIC policy—it could be just the lifeline you need!

LIC Loan Application Form No 5205 Download: